[ad_1]

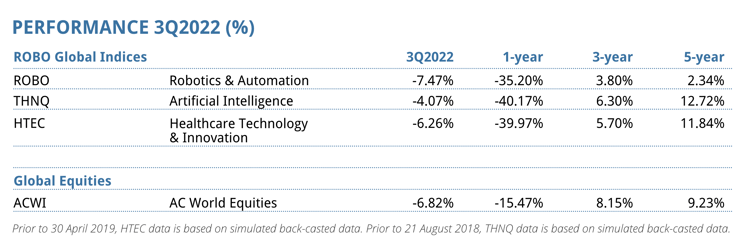

The ROBO World indices declined in keeping with world equities in Q3 all through the face of maximum inflation and jumbo worth hikes to finish the quarter 42%-50% under their all-time highs in 2021. The Robotics & Automation Index (ticker: ROBO) misplaced 7%, the Synthetic Intelligence Index (ticker: THNQ) dropped 4%, and the Healthcare Expertise & Innovation Index (ticker: HTEC) declined 6%. Valuations have compressed efficiently under long-term historic averages. On this report, we give consideration to most vital tendencies and massive movers all by means of our portfolios.

Webinar Transcript:

Jeremie Capron:

Hi there there everybody and welcome to ROBO World’s October 2022 investor establish. My decide is Jeremie Capron, I am the director of research and I am speaking to you from New York. And with me at present my colleagues Invoice Studebaker and Zeno Mercer. We’ll begin with a quick reminder of what we do at ROBO World after which we’ll share some ideas about what’s taking place all through the markets. After which we’ll take a additional in-depth try every of the three index portfolios, ROBO, THNQ and HTEC. And naturally we’ll be taking your questions, so be at liberty to type them into the Q and A space on the underside of your present.

So let me begin with this fast overview of ROBO World. We’re analysis and funding advisory company that is targeted on robotics, AI and healthcare utilized sciences. And we cope with three important index portfolios which might be tracked by almost $3 billion in belongings. These are primarily in ETFs. And our first index portfolio is ROBO, that was the primary robotics and automation index and it began nearly 9 years beforehand in 2013. And the second is THNQ, T-H-N-Q, that’s the synthetic intelligence index. And the third one is HTEC, the healthcare know-how and innovation index. And also you would possibly even see correct proper right here the annualized returns since inception of every index as of the best of September, 2022.

So these portfolios, they mix analysis with the advantages of index investing all through the ETF wrapper. They’re composed of greatest at school firms from all through the globe. The small, mid and huge caps that we analysis and we rating on fairly just a few metrics, and top-of-the-line scoring shares make it into the portfolios. Then we rebalance each quarter and the result’s portfolios which have a really low overlap with broad fairness indices like DSNP 500 or the NASDAQ and utterly totally different world fairness indices.

Okay, so let’s discuss what we’re seeing all through the markets. And the elephant all through the room correct proper right here is that the world’s greatest firms on the forefront of robotics, of AI, of healthcare know-how as represented by the ROBO world indices, they’re now purchasing for and selling 40 to 50% under their 2021 highs. Optimistic, loads of shares are on sale right now. World equities are down bigger than 25% this yr, however these typically are normally not your frequent shares correct proper right here. As quickly as additional, we’re speaking relating to the know-how and market leaders. They’re firms which might be typically very worthwhile and rising masses sooner than the monetary system. In actuality, as quickly as we try their steadiness sheets, we uncover {{{that a}}} majority of the businesses all through the ROBO, the AI and the healthcare tech index, they’ve more money than debt. And they also also have a optimistic internet money place.

And extra importantly, plenty of these firms are relative beneficiaries of the present setting. When you concentrate on the issues that we face at present all through the world monetary system, we now have the labor shortages, we now have rising prices all by means of the board. The one clear and simple response from enterprise leaders is automation and enterprise leaders and firms are making it a extreme precedence. In actuality, and Invoice will come as soon as extra to that shortly, demand for automation at present is at doc highs and rising and there’s additional demand for robots and automation that suppliers can current.

And on the an an identical time, this down market in equities, we take into consideration is giving retailers a possibility to spend money on these firms at a reduction. In actuality, the three portfolios are actually purchasing for and selling considerably under historic frequent valuations and we’ll come as soon as extra to that. So let’s try robotics and automation first, and for that I will maneuver it on to Invoice Studebaker.

Invoice Studebaker:

Good morning everybody. Thanks for the time and curiosity. Jeremie, thanks for the introduction. Merely to take a look at up on Jeremie’s options, we really know that the third quarter was a troublesome interval for retailers. And September was a strong illustration of merely how troublesome it may very well be to be targeted on the long run horizons, significantly when the market is ceaselessly being tripped up by a confluence of things and occasions. And we perceive that these are robust occasions. Concurrently Jeremie commented, the down market is giving retailers really a welcome totally different to revenue from deep reductions and spend money on firms that we see they’re delivering on the compulsory automation utilized sciences.

And we take into consideration, as Jeremie furthermore commented, that this has created an setting, it is sort of a wonderful storm for retailers, to extend publicity to a supercycle for automation and demand for automation utilized sciences, as I will remark shortly in additional facet, has on no account been bigger and the problems which might be decreasing fairness costs that we’re all considerably acquainted with, the labor shortages, the compressed margins, the availability chain bottlenecks and the necessity to chop once more working prices are considerably rising the necessity for adoption. And as we doubtlessly go correct proper right into a recessionary setting, we predict companies are going to be very wanting to wish to spend on effectivity and automation.

As you in all probability can see for the quarter, the ROBO index declined about 7%, which is similar decline for world equities, which has resulted in valuations which have compressed efficiently under our historic averages. And the broad weak spot was represented in 10 of our 11 sub sectors that we invested that had confirmed losses. And importantly although, as we glance into the fourth quarter earlier, we see a wonderful totally different for retailers to sharpen their pencil and add to this, what we take into consideration, is inevitable automation theme. That is on sale like a great deal of the market.

And we see an infinite discrepancy as a result of the place inventory costs are, inventory costs are 40, 50% off their all time highs regardless of the sturdy fundamentals of automation that we’ll contact on shortly. And loads of of our constituents really are firing on all cylinders and should’t make sufficient to fulfill the demand. As you in all probability can see correct proper right here on the valuations, the PE is 12% cheaper than our historic frequent. And I do wish to underscore that our valuation depends on PE, many different tech exposures are based completely on worth of product gross sales, and in a variety of circumstances are arguably over owned and overvalued. I do wish to make the remark that lower than 3% of ROBO is all through the S&P 500. So it is a distinctive publicity that moreover could be very beneath owned and underappreciated by a great deal of the market and we predict that may very well be a likelihood.

Subsequent slide please. So from an EV to product gross sales standpoint, you in all probability can see that we’re purchasing for and selling fairly near parity to historic valuations. So ROBO is purchasing for and selling spherical 2.7 occasions EV to product gross sales. As quickly as additional, the context of the place know-how trades, I point out, Adobe merely made a purchase order order order of an AI asset for 40 occasions trailing EV to product gross sales. In order that hopefully provides you some context that I will not say that we’re hardly overvalued. Notably, I actually really feel our valuation of our portfolio has superior fairly considerably by the years and has develop to be masses growthier, in order that’s sort of skewed the valuation of the upside. So I’d argue that even at 2.7 occasions relative to the sooner, our valuation is fairly low worth.

And simply as a assemble on to that, what we now have seen correct proper right here on the market obtainable available in the market, we now have had three consecutive quarter declines all through the ROBO index and that is really sort of an unprecedented improvement since we launched the index as soon as extra in 2013. And it is solely similar to the as soon as extra confirm going as soon as extra to ’08, ’09. And importantly although, earnings estimates, I do know that that is perhaps sort of the elephant all through the room, that individuals suppose the earnings estimates are going to come back again once more down dramatically. We really haven’t seen that nevertheless. For 2022 and 2023, earnings estimates have solely been lower by about one to three% of the final word three months and simply 6% over the earlier yr. And this I actually really feel is a mirrored image of the power and demand for automation utilized sciences and decisions.

And really importantly, the power for ROBO firms to deal with rising prices and provide chain challenges. Quite a lot of these firms have been spherical for a variety of years and have had the facility set to adapt to and cope with absolutely utterly totally different financial environments and to have the facility to maneuver on and costs. And I actually really feel importantly, the earnings estimates have seen truly optimistic upgrades over the earlier three and 12 months and diploma to a couple 12% product gross sales progress for 2022 and about 9% for 2023. Though the market is skeptical that estimates will not come beneath additional strain, that thus far has been the report card.

Subsequent slide please. In order Jeremy sort of alluded to, ROBO is designed to be diversified, it is designed to be invested in among the many better of breed know-how firms globally all by means of the ecosystem of the know-how. So what makes the robotic or automation work? After which the options, the place is automation being deployed? Sadly, this drawdown, as everyone is conscious of, has been considerably violent and excessive and has resulted in possibly in all probability essentially the most essential drawdown we now have seen. Even when 50% of the portfolio has what we see as an exact worth, that being uncovered to industrial automation, logistics automation, healthcare. To not stage out, as Jeremie alluded to, that roughly spherical 60% of portfolio has an web money place and no debt. So these firms are efficiently positioned to native climate the storm, like they did all by means of Covid.

And this enterprise is importantly traditionally grown the perfect line two to some occasions that of the market and we anticipate that to proceed. To not stage out yr thus far, FX has been about an 800 foundation diploma headwind and the swap all through the greenback really has been considerably parabolic and we predict there’s prone to be a reversion of point out and there may very correctly be an outstanding tailwind as we start to maneuver into 2023 and former.

By the use of the large inventory strikes, we now have had a pair fortunes to the upside, not sufficient in actuality, iRobot was up 57% all through the quarter, as a great deal of you is prone to bear in mind, they’re a frontrunner in shopper robotics and so they additionally agreed to be acquired by Amazon in an all money transaction for 1.7 billion. This does importantly signify the twenty eighth takeout since we launched ROBO as soon as extra in 2013. And whereas we cannot forecast what the MA setting’s going to appear like, a great deal of our firms are, as quickly as additional, leaders of their enterprise. And as asset costs come down, we predict that they actually develop to be additional favorable all through the eyes of strategic and monetary buyers.

Luminar Expertise furthermore had an honest swap to the upside. They’re a frontrunner in lidar know-how for autos and cars. The inventory was, I actually really feel the effectivity was considerably supported by the conviction of insiders. The CEO did buy upwards of $6 million all through the quarter. Nonetheless importantly what’s really transferring the inventory is their enterprise success with bulletins. They launched partnerships with Mercedes and Nissan, which intend to combine their know-how in most of their autos by 2023, or I am sorry, 2030. So we do anticipate to see additional progress correct proper right here on the enterprise entrance.

Then within the case of the sectors that we really preserve terribly convicted on, one home to provide consideration to is industrial automation. And an earlier contact upon that Jeremie furthermore did is that industrial automation really is firing on all cylinders to fulfill demand. And Yaskawa, which is a gigantic industrial robotic producer, merely launched today that their orders had been up 34% yr over yr. Fanuc, which is essential industrial robotic producer, has been fairly vocal about their backlog, which now could be in additional of 1 yr. Importantly, Teradyne, which furthermore performs a key place in industrial automation, has remaining quarter talked about their industrial automation progress was up 29% yr over yr. We anticipate that to proceed as quickly as they announce their outcomes shortly. They’re thought-about one among many largest producers of collaborative robots by way of their buy of Frequent Robots, which is a Dutch company. That enterprise has furthermore really been firing on all cylinders. That enterprise remaining quarter noticed robotic product gross sales truly up 30% on a 55% comp.

So enterprise really stays fairly robust and healthful. These asset costs are actually fairly attention-grabbing for retailers to try. And regular, inside the event you try robotic density, and in order that’s trying on the variety of robotic installations per 100 folks, give it some thought or not, the worldwide frequent is only one.2 robots per 100 workers. And so we now have an extended technique to go within the case of the place penetration prices are going. Merely to place that in context, the US has roughly 2.5 robots per 100 workers. China might also be 2.5, however they’ve grown from 0.5 to 2.5 in 5 years. So fairly glorious progress there. Japan’s about 4, Germany’s 4 and Korea is 9.

So this all is all through the context of a world setting the place world manufacturing employs about 500 million folks globally. So if robots are stealing our jobs, they don’t seem to be doing an outstanding job of it and we predict there’s essential progress all through the years forward. That is it for my ready marks. I suppose I will maneuver it on to-

Moderator:

Thanks Invoice. Hey Invoice, prior to we swap on, we now have a specific query to ROBO from the viewers spherical why we embrace Nvidia however not Micron or Intel or STM. Would possibly you discuss to that?

Zeno Mercer:

Optimistic. Hello there. Hey everybody. Zeno correct proper right here masking THNQ at present. And okay, might you repeat that query? It was spherical possession?

Moderator:

Optimistic. In order that they’re asking all through the ROBO Index, we embrace Nvidia however not Micron or Intel or STM. So might you discuss relating to the excellence between ROBO and THNQ and the place these firms would fall?

Zeno Mercer:

Appropriate, okay. I actually really feel top-of-the-line methods we try it isn’t solely, sure, these are all concerned in parts of sort of fashionable society, robotics, AI, however we’re looking for firms which have probably possibly in all probability essentially the most funding or publicity to those areas. And I am truly going to cowl in a video later, however I’d say some factors now, at their latest AI day, they’re rigorously invested not solely all through the chips however the software program program program aspect of factors. And for the time being we take into account them additional of an AI and robotics play. I point out, they’ve software program program program considerably for it and we merely have stronger conviction spherical it going ahead. Clearly firms like Micron are making large investments and are vital to society, however we’re attempting to get publicity to specific areas and under no circumstances merely make investments normally firms all through the area. I point out, we’re ready to cowl additional later as quickly as I discuss additional about Nvidia for a bit.

Yeah, we’re ready to go to the following slide. Reflecting on the quarter, the THNQ index was down 4%, truly outperforming world indices and the S&P, and we’re down 47% since November 2021 excessive. So the AI area has been underperforming even whereas fundamentals have been bettering in some strategies. And I will get to that. From a valuation standpoint, Ford EV product gross sales are persevering with downward and so they additionally’re truly on the quarter finish, they’re at 4.6, which is under March 2020 lows. Even whereas adoption progress, digitization and a great deal of large tendencies and tailwinds are coming, not solely now however 2023 and former. And we’ll cowl that. And among the large factors that occurred is we had earnings deceleration this yr all the way in which by which proper all the way down to 11.2%. So regular our firms grew, however this was down from 27.9% in 2021. Clearly it was a really large yr for earnings.

And the present forecast right now could be a stronger rebound as soon as extra all through the low twenties for 2023, 2024. So right now, I point out, this has been a troublesome yr. Of us have been sort of reorganizing and determining what strikes they are going to make, however sure areas of the monetary system are seeing and have large backing for continued funding over the following loads of years and quarters. So I actually really feel it is vital to suppose and know that AI is turning into an rising share of agency authorities spend and moreover it’s an enabler of GDP progress and price financial monetary financial savings. So there’s each progress parts and deflationary parts which might be concerned correct proper right here and we’ll cowl that.

Subsequent slide. Yeah, so we truly had, regardless of the index being down, we had outperformance, we had 79% beat extreme line expectations and 85% beat earnings. And I actually really feel spherical 87% are anticipated to be worthwhile subsequent yr. So inside the event you’re obsessive about these firms, we now have excessive pricing vitality, they’re vital avid avid gamers to the monetary system, whether or not or not or not it is funding spend from the Fortune 500 in quest of to digitize their merchandise or make new merchandise and even merely uncover worth financial monetary financial savings all by means of current chain, operations, factors like that. And even merely utilizing AI as a core product and to extend the product improvement, whether or not or not or not exact world world merchandise or digital merchandise, decisions. So there’s developer operations, cybersecurity, a great deal of angles there.

Many firms even have raised steering all through the index resembling Samsara, which truly raised 3 cases this yr irrespective of their very private current chain factors. That is extreme line and backside line. From large data and analytics, we truly noticed a standout from firms like Alter X, which is seeing 50% yr over yr progress and 90% gross margins. And irrespective of everybody being afraid of, oh, what is going on on to occur with spend, and the place cash goes is shifting this yr, I actually really feel we’re all seeing that. And Alter X is seeing their largest pipeline in historic earlier for digitization automation of bringing in data and determining what to do with it and discovering methods to streamline capabilities with elevated labor worth, inflation.

So these firms present very excessive ROI and that is the explanation as quickly as we’re establishing and reevaluating the index and rebalances, we’re taking a look at what firms are enablers right now. And that is each the infrastructure aspect and the precise software program program aspect which might be truly getting used at present. It is the provision and demand. And likewise you would not assemble semi chips, there’s not a set off, and I will get to this subsequent, relating to the CHIPS Act, if there weren’t an vital aspect coming down the freeway for that. And most of these chips, the chips being produced there aren’t going to be coming on-line till 2025 and former.

So we’re ready to really go to the following slide now. I suppose I already lined the outperformance correct proper right here, nevertheless it was, irrespective of elements all through the monetary system, it was a really robust quarter and we noticed fairly sturdy reassuring steering from many areas. I actually really feel one among many essential troubled areas is on shopper, though our shopper index or the patron sub sector and e-commerce had been among the many greatest performing this remaining quarter, they’d oversold in Q2.

So inside the event you’re sort of looking for 1 / 4, I point out you are going to have shifts there, however that is the explanation we even have publicity and make allocations of those absolutely utterly totally different areas. Going to speak about Semi exact fast, I actually really feel thought-about one among many largest factors that occurred was two factors. A, we handed the CHIPS Act and we furthermore had US commerce restrictions, Semi effectivity regardless of the CHIPS Act being handed, irrespective of Europe furthermore declaring they wish to double manufacturing of Semi chip performance themselves, getting away from Asia manufacturing area, our Semi index was down 12%.

A part of it’s falling in lockstep with the monetary system and the entire thing else. A part of it’s sort of overblown fears spherical what’s taking place with the China commerce restrictions and likewise spherical shopper, PCs, Cell. Apple launched that they’ll not enhance manufacturing of the iPhone 14. And we now have some publicity there, however regular that is PC and private. If you happen to’re speaking about cloud, AI, automotive and connectivity, which is the place we truly try to allocate additional publicity to on that aspect of factors, on the infrastructure aspect, we’re truly seeing robust demand and forecast. As an illustration, Qualcomm, which is anxious in a variety of, they’ve I actually really feel $7 billion enterprise fashions. They’ve seen their automotive pipeline go from 19 billion to 40 billion in a single quarter. So the inflation low price act, all these items people are making, we might not have full EVs nevertheless, a minimum of all through the sense that they don’t seem to be far and wide.

I point out, inside the event you try share of autos on the freeway, it is 0%, 0.001. Nonetheless, clever clever autos that require additional processing, you have received bought EVs, they require additional semiconductor chips and processing connectivity and as well as you’re seeing an infinite enhance in demand spike there. So whereas we’re seeing a oversaturation in that half, we’re seeing large progress. After which there shall be one totally different improve cycle for wearables and factors like that, that that’ll come as soon as extra on-line. Nonetheless it’s sort of smoothing out the tactic correct proper right here. And that furthermore comprises parts, sensors and laptop computer pc imaginative and prescient.

By the use of cloud demand, we’re seeing large pull by way of nonetheless. Arista, which makes networking switches and software program program program for these large cloud heart deployments from the large tech firms and enterprise and others. They outfitted very sturdy steering in 2023 at their remaining establish. So inside the event you are trying by way of the noise and seeing what’s an indicator of factors to come back again once more, it is continued funding on this area. And we now have acquired loads of hundred billion greenback plus tailwinds coming by way of 2023 and former. And it could not be additional apparent how vital it’s than for many who get to the commerce restrictions.

Nonetheless the CHIPS Act, merely to present everybody an event of how we try the infrastructure area, they need to make the semiconductors themselves, so you may have Nvidia, Intel, Samsung, avid avid gamers like that. You even have firms like LAMB Analysis and ASML, which make important parts to that. To make tiny three nanometer parts, you want very costly, very refined gear. I point out, it is just a few of in all probability essentially the most spectacular tech we now have on the planet right now. Every of those units although have a variety of years pre-order, there is a backlog, and so they additionally run $180 million per pop for ASML as an illustration, it is a Dutch based company.

As a share of spend, okay, as an illustration there is a $50 billion Chips Act and a complete bunch of billions coming on-line in manufacturing all through the US as an illustration, not even speaking relating to the EU, one $17 billion plant in Texas, $10 billion of that’s going to semi manufacturing gear. So merely to present you a scale, and I do not suppose the market’s really reflecting that, semi’s ineffective, extended reside semi, people are like, “Oh, PC, gaming,” there’s masses approaching board. I actually really feel that is one issue to remember for many who’re sitting correct proper right here obsessive about what’s snug and what’s truly going to get cash all through the following couple of years.

China restrictions, Nvidia, Nvidia’s had a tough yr, gaming’s down after which the China commerce restrictions have come on board. They don’t seem to be set to start out for some time till subsequent yr, 3Q subsequent yr. And it truly leaves them with some wiggle room. So it isn’t principally they can not promote into China, they solely cannot promote specific chips and factors. Actually rumors are saying that they are truly getting loads of orders and people are stockpiling right now. So take that as you’ll. Nonetheless I actually really feel in the end it merely reveals how vital these are and that there is going to be elevated emphasis and funding correct proper right here.

One totally different concern I needed to speak about briefly is the Tesla robotic. That was a fairly large deal for plenty of, all through the sense that it launched consideration to the world. Elon has that affect. He targeted on EVs, he primarily made the EV market. Robots although are already an infinite market, clearly that is the explanation you guys are all correct proper right here is attempting to know and take heed to that and from our angle. So what I actually really feel goes to occur correct proper right here is A, shopper robots have very low penetration. In actuality, it is primarily null. You do have additional automation in semi and automative and manufacturing, nevertheless it’s one totally different market that basically simply is not being appreciated is the robotic area and AI area with the facility to visualise and primarily, they need to function all through the digital world to have the facility to function all through the bodily world. That is going to take elevated computation and funding in cloud, AI, connectivity.

So I actually really feel that is the takeaway there. I do not really wish to make a projection on when will Tesla robotic be in folks’s properties if it should, et cetera. Nonetheless I actually really feel it is merely one issue to remember.

Yeah. So talking of newest factors, we now have acquired a mannequin new addition. We added CrowdStrike this quarter. So CrowdStrike for lots of who don’t know, is an American cybersecurity company that was based in 2011. That that that they had their first product in 2013. They have been on a roll correct proper right here. Now we have now been watching them for a while and so they additionally’ve really confirmed resilient. And as quickly as we’re obsessive about making an addition to an index, we try quite a few factors, We try their market and know-how administration and we furthermore try what are they investing in, have they acquired a pipeline of merchandise which might be going to proceed to make them receive market share and enhance their addressable market.

Appropriate now they have been rising, their 5 yr progress worth is 94% anticipated to hit 1.5 billion this yr and some.2 billion subsequent yr. So their AI enabled cybersecurity decisions are trusted worldwide, with a TAM addressed estimated to be $75 billion and that is rising to 125 billion with new merchandise. They’ve a 97% retention worth and so they additionally turned worthwhile in 2021. So this is not just a few progress story. Their EPS is projected to develop 50% over the following loads of years. Going as soon as extra to funding, they’ve 25% of their earnings investing all through the R&D and in merges and acquisitions. They’re making clever acquisitions, they’re investing, we’re very assured that they’ll proceed to be a frontrunner in AI enabled cybersecurity.

At this diploma, I will maneuver it on to Jeremie to debate our healthcare index.

Jeremie Capron:

Okay, thanks Zeno. So HTEC is the healthcare know-how innovation index that we launched in 2019. And in the previous couple of years we now have seen the convergence of robotics, AI and life sciences that has enabled some breakthrough advances. And we take into consideration that healthcare is the one large financial sector that is going to be profoundly reworked by know-how over the approaching decade. And so we assemble the HTEC index utilizing an an an identical recipe to the ROBO index. Which suggests the index portfolio consists of among the many greatest at school firms from throughout the globe which might be reworking the healthcare enterprise all by means of 90 areas you might even see on this pie chart. So there’s robotics, which is about robots all through the working room, all through the pharmacy, in hospitals and so forth.

And you’ve got data analytics, which is about firms utilizing software program program program to derive insights from the info that we now accumulate spherical victims. The data from medical trials, the info from medical imagery and AI is an rising variety of utilized in diagnostics and drug analysis and automating, or it is additional about augmenting the work of clinicians, augmenting the tempo and accuracy of a diagnostic. After which you may have telehealth, which is about decentralized remedy, like distant physician affected particular person visits that we’re now all acquainted with, nevertheless it’s furthermore about wearable units for the monitoring of glucose ranges or cardiac practice and so forth.

You have received genomics in actuality with firms offering the units to decode the genome and firms creating early most cancers detection decisions. You have received firms with gene enhancing know-how and even artificial biology the place we create artificial genes. After which lastly you may have a bunch of medical and surgical models like 3D printed implants, you may have coronary coronary coronary heart pumps, miniature coronary coronary coronary heart pumps, neurovascular units and so forth. So it is a fairly fairly just a few basket of presently 78 firms, large and small.

In actuality, almost half of the businesses all through the portfolio are small and mid caps, however they’ve one contemplate frequent, which is know-how and market administration of their respective sectors. And on the following slide you in all probability can see that the portfolio carried out very efficiently in 2019, 2020 and 2021 prior to that sort of indiscriminate promoting primarily lower in half. And so the HTEC index has now declined 50% from its excessive of February 2021. And all through the meantime, the earnings has grown by bigger than 30%. So earnings grew by 22% remaining yr. And this yr we are going to see an additional 12% and subsequent yr we’re taking a look at 10% product gross sales progress, 2023. So HTEC is now purchasing for and selling on 3.9 occasions ahead enterprise worth to product gross sales. That is on the median for the basket. And that compares to the acute yr of seven.2 occasions and the low all through the Covid lockdown panic, that was 4 occasions. So we are actually under the Covid lows within the case of valuations and I actually really feel that may very well be a vital diploma to remember.

So I wish to contact on a variety of of the companies correct proper right here so that you just get a bigger sense of what is all through the portfolio. And I’ll begin with a variety of of the extreme performers all by means of the quarter. You in all probability can see Butterfly Neighborhood’s correct proper right here, that was up over 50% prior to now three months. So Butterfly’s in our diagnostic sector and it has developed the IQ ultrasound determination, that is an ultrasound system that’s 80% cheaper than normal units. It is small, it truly works with smartphones and tablets and has a software program program program platform that’s subscription based. In order that they’re rising entry to ultrasound based analysis dramatically. And it is rising very quick, about 30% per yr, with margins above 50% on the gross stage. So Butterfly has $300 million all through the financial institution, so an excessive amount of room to proceed to scale and in the end we predict it is a very possibly acquisition purpose.

After which Penumbra correct proper right here, Penumbra is an organization in our medical machine sector. They’ve developed very revolutionary surgical models for neuro and vascular circumstances. So it is about stroke treatment and eradicating clots and thrombectomy and coiling methods. And Penumbra’s tech is superior to the standard stent method, so that they are furthermore rising quick, like 15, 20% a yr. They usually even have elevated than anticipated margins as quickly as they reported and so they additionally’re speaking about accelerating progress and procedures into the rest of the yr. They’re making aggressive constructive factors. Furthermore they’ve pretty a variety of merchandise rising over the following 18 months.

And AxoGen, you in all probability can see correct proper right here, which was up bigger than 40%, that is in a regenerative remedy sector. AxoGen has developed an answer to revive the bodily injury to nerves, peripheral nerves. And they also moreover’re capable of restore feeling and effectivity of nerves. Principally it is a nerve graft and it is the one off the shelf human nerve allograph inside the market. And AxoGen furthermore had elevated than anticipated earnings remaining quarter. And the administration commented that they anticipate the product gross sales progress to return to mid kids by the best of the yr.

And at last, I needed to the contact a bit bit on genomics and precision remedy, which collectively account for just a few quarter of the portfolio. And also you would possibly even see on this slide some examples of firms in HTEC, a variety of of the know-how and market leaders which might be really powering the genomics enterprise. And we predict genomics is totally a revolution and it is taking place now. It is a revolution on account of genomics permits a extremely new method to remedy and the early detection of illness. It isn’t solely hereditary illness nevertheless furthermore persistent illness like most cancers. And since it furthermore permits custom-made remedy, custom-made remedy which suggests individualized remedy versus the present mannequin of huge pharma the place you may have a one dimension matches all sort of molecule that worth billions of {{{dollars}}} to ship to market. Correct proper right here we’re speaking about therapies which might be tailor-made to the person.

And the rationale why this revolution is occurring now could be on account of we now have pretty priced gene sequencing know-how and the worth of sequencing the human genome is declined dramatically from billions of {{{dollars}}} with the primary human genome enterprise a really very long time beforehand to now beneath $1000. And if there’s one company that is been most vital the value within the case of driving down the worth of gene sequencing, that’s Illumina, which is the market chief. They’ve bigger than 20,000 machines put in worldwide. They’ve bigger than 75% market share globally. And remaining yr they grew earnings by 40%. And about two weeks beforehand they launched the mannequin new NovaSeq X, which is the mannequin new sequencing platform that will take sequencing prices down by bigger than half to just some hundred {{{dollars}}}. And the final word time we noticed such an infinite worth decline, that drove fivefold enhance on the market obtainable available in the market dimension for genomic sequencing.

And that is what permits genomics testing. And I discussed the early detection of the sicknesses like most cancers. So Natera as an illustration, is the market chief in prenatal DNA testing. They’ve a non-invasive confirm for abnormalities and Natera is now pushing into most cancers screening and implant rejection testing as efficiently. Veracyte, that is one totally different company that is reworking the diagnostic of most cancers utilizing DNA know-how. They’re working in thyroid and lungs and breast most cancers testing. They’re rising the accuracy of diagnostic and avoiding pointless surgical procedures for victims.

And I furthermore spotlight Twist Bioscience correct proper right here. Twist is the chief in DNA writing. So it is the synthesis of genes which they do with a silicon chip to fabricate enormous variety of artificial DNA at a low worth. They now have 1000’s of buyers together with pharma firms, together with analysis facilities, nevertheless furthermore industrial firms, chemical firms, agricultural firms.

And at last I wish to contact on Alnylam. Alnylam is an environment friendly event of precision remedy and individualized remedy. They pioneered the RNA interference therapeutics, we establish that RNAI. They usually additionally merely obtained their fifth approval in lower than 4 years for the treatment of polyneuropathy illness typically referred to as ATTR. And this treatment that they are rising with might attain billions of {{{dollars}}} in product gross sales. So for many who research that to the market cap of Alnylam at present, there’s I actually really feel attention-grabbing discrepancy.

So in full there are 18 firms in our genomics and precision remedy half and so they additionally account for spherical 25% of the HTEC portfolio. And I hope you perceive that there our portfolio establishing course of correct proper right here is admittedly about diversification, offering publicity not solely to small areas like genomics, precision remedy, however to all areas of the healthcare enterprise the place know-how is making a distinction.

All right, so I’ll pause correct proper right here. I actually really feel we now have lined loads of flooring, I actually wish to take a variety of of your questions and I see we now have a query about earnings trajectory for our portfolios. What’s the anticipated earnings progress for this yr and subsequent? And I actually really feel we’re ready to begin with ROBO. I will the contact upon ROBO after which Invoice and Zeno can contact upon the choice portfolios. Nonetheless primarily we predict we’ll shut 2022 with about 15% EPS progress for ROBO. So remaining yr we had bigger than 40% EPS progress. This yr we’re nonetheless taking a look at 15, which is considerably forward of what you’d anticipate for the S&P 500, significantly inside the event you exclude the power sector from the S&P 500. We’re primarily taking a look at a compression in EPS for this yr for the broad market. For ROBO, it is 15%. And for subsequent yr, we’re taking a look at in regards to the an an identical, so 15 to 17% is the anticipated EPS for ROBO together for subsequent yr. Zeno, do you wish to contact upon AI?

Zeno Mercer:

Optimistic, Hello there. Yeah, so within the case of EPS progress for the THNQ index and its members, I will sort of break up it into software program program and companies and the infrastructure half. Infrastructure has been a bit smoother this yr and we noticed 29% EPS progress in 2021, this yr we now have seen and projecting for the total yr, 22%. So a slight pull down. On the flip aspect on software program program and companies, we noticed 29% remaining yr and seven.9% this yr, with eCommerce and shopper being the most important laggards. Nonetheless that is anticipated to rebound all through the next yr respectively, shopper and e-commerce to 25% and 64%.

And I actually really feel trying 2023 and former, the projections are taking a look at 11.6 this yr. Widespread THNQ index is in quest of to get as soon as extra into the twenties progress for EPS, so 20.4 after which even bigger clip in 2024 and former. I actually really feel a variety of of the standouts inside that may very well be neighborhood and safety, which is rising at 49% this yr and anticipated to nonetheless maintain elevated twenties, low thirties subsequent yr. So that you just’re seeing some rebound in some areas and others are merely going to see continued power for EPS.

Invoice Studebaker:

Jeremie, merely to fall on to your options, perhaps nearly revenues for ROBO, I actually really feel importantly, that is sort of the elephant all through the room, everybody thinks there’s going to be a fairly dramatic low price in estimates. Clearly we now haven’t seen that occur. That could be a threat. Income progress ROBO is unquestionably anticipated to be about 13% this yr and subsequent yr a bit over 8%, which is in keeping with its historic averages. So even when there’s strain from the broader markets, we do anticipate our indices to typically develop two to some occasions to that of the market, which traditionally they’ve. So we truly actually really feel fairly good in regards to the place these companies are positioned as we go into 2023 and former.

Jeremie Capron:

Okay, thanks Invoice and Zeno. And I see we now have a query about potential ESG elements with the genome oriented firms, considerably governance points. So correct proper right here at ROBO World, we take ESG very severely. We launched our ESG safety in 2017, so happening 5 years now. And we now have improved the safety persistently by the years, primarily given the pool that we had from a variety of of our European retailers. And so the safety at present is terribly full and yow will uncover all the small print on the web website online and it is really targeted on excluding firms that fail sure requirements that we now have established in keeping with the Febelfin requirements over in Europe. It is thought-about one among many strictest requirements. So we try environmental effectivity, governance and social elements in actuality. We use our non-public inside analysis to guage each company that is in our funding universe, however we furthermore use exterior assist from preserve analytics that helps us flag any potential elements or controversies as they arrive up.

Now within the case of query all through the genome, I actually really feel it is an home the place we’re seeing loads of debate, whereas isn’t any debate is spherical utilizing genomics for early detection of illness on account of the idea correct proper right here is that you will choose up a illness prior to it turns into an infinite draw again within the case of your functionality to remedy, in actuality, and your likelihood of survival, nevertheless furthermore within the case of the worth to the healthcare system. And so there seem to be unanimous view all by means of the enterprise and safety makers spherical the fact that genomics in diagnostics is a no brainer. And so we do not anticipate any elements there. The place some elements might doubtlessly come up I actually really feel is spherical gene enhancing on account of correct proper right here we’re making modifications into the human DNA. In a variety of circumstances we’re making modifications into cells in order that it may in all probability produce specific proteins and proteins that will assist battle in route of a illness.

And it’s nonetheless very early days. Inside the present day there isn’t any FDA accepted gene enhancing based remedy. Nonetheless in 2020 we noticed the primary dosing of a human affected particular person with such an method and we had some pretty promising outcomes with that and that is the explanation you have received seen the gene enhancing shares carry out barely correctly in 2020 and first half of ’21. Now they’ve come down a great way, however I actually really feel that is the place we now should pay a bit additional consideration.

And the final word remark I’d make spherical that’s that clearly we now have seen a change all through the trajectory on the FDA within the case of how briskly they have been approving gene therapies and cell therapies. So for a extremely very very long time till I would say spherical 2019 or so, there was reluctance by the FDA to quick monitor this analysis. Nonetheless at present it has been a transparent acceleration and whereas there’s solely a handful of gene and cell therapies accepted on the market obtainable available in the market at present, there is a backlog of loads of a whole bunch of these presently in medical trials. And so we anticipate the raft of approvals over the following loads of years.

So I’ll cease correct proper right here as quickly as additional, for many who wish to ship up any questions, please type them into the Q and A space. There is a query relating to the autonomous system, sub sector, I actually really feel Invoice, you could wish to take that. It is presently at 0%, was considerably bigger than that, Invoice, you wish to give some coloration.

Invoice Studebaker:

Yeah, that is right, it’s 0% right now. And we did have one constituent in there, which was iRobot, clearly taken out. And simply because an organization is way from an index, we do not mechanically merely put one consider, as Jeremie talked about all through the sooner a part of the presentation, we’re in quest of to find out firms that we predict are leaders of their enterprise, firms which have a technological mode spherical their enterprise, have dominant market shares. In order that’s a extremely vital necessities for what we’re looking for.

And we do anticipate the patron sector to start to evolve. Clearly we’re fairly obsessive about Tesla’s ambitions correct proper right here and I actually really feel as the value components come down, because of the use circumstances broaden, I actually really feel we’ll see a pure evolution all through the patron sector, however we now haven’t had loads of progress there nevertheless. With regard to your query, I suppose you had been commenting about Group Gorge and one totally different entity in Spain. As quickly as additional, I actually really feel the vital attribute about what we’re attempting to do at ROBO is put in leaders all through the enterprise. Whereas these firms would possibly want some ambitions in robotics, they’re clearly not getting there nevertheless. Group Gorge in France considerably, not solely would we query their market share in technological administration, there’s a liquidity downside for firms to go in our index, they need to have a minimal market cap and minimal liquidity per day. And each of these firms would fail these screens. So I do not, Jeremie, one other ideas, however that is.

Jeremie Capron:

Invoice, there’s one totally different query about FX attribution for ROBO yr thus far. I do know you touched on that earlier. Do you wish to repeat that?

Invoice Studebaker:

Yeah, clearly it has been an infinite headwind. It has been spherical 800 foundation components since we launched yr thus far, it is nearly positively about 12, 1300 foundation components since we launched in 2013. So we now have truly absorbed that pretty efficiently, we really would hope that that can develop to be a tailwind. There have been years the place FX has been a tailwind and whereas we cannot anticipate that, we really do not hedge for it. And we predict over time there’s a reversion in point out that usually occurs in international trade markets. And supplied that top-of-the-line methods the index is constructed, we’re attempting to find out firms that we’re detached to the place they’re positioned. It simply so occurs about 45% of our index is in North America and about 55% internationally. And as quickly as additional, important attribute for us is defining who the market leaders are, enterprise leaders, know-how leaders, and we’re detached to what we area they’re in.

Jeremie Capron:

Okay. Now we have now now one remaining query relating to the turnover that we see all through the index. I’ll take that. So primarily the turnover comes primarily from the quarterly rebalancing. The index itself is fairly secure within the case of the constituents. Now in actuality the weightings can change on the margin because of the scoring evolves, so we rating each company in our analysis universe and the rating drives a legibility into the portfolio and to some extent the place dimension.

Scores evolve every time the analysis crew interacts with the corporate or there is a agency motion, there’s new particulars about market administration or know-how administration. Furthermore the earnings publicity to the issues that we’re going after, the scores will swap, however the foremost driver of turnover is admittedly the rebalance when each quarter we return to that rating pushed weighting. And in order that drives about 25 to 35% turnover in a typical yr, so 4 rebalances per yr. Nonetheless the modifications within the case of constituents really typically are normally not that very important. In actuality, each quarter you may typically see one or two new inclusions or exclusions on the basket of about 80 firms. That is the place the turnover comes from.

Zeno Mercer:

I am going in order so as to add one issue to the THNQ index exact fast. Considering by way of THNQ, we now have 71 index members and this earlier quarter we had 4 takeouts, one addition. Final yr we had 5 or 6 takeouts from M&A alone. And thought of one among many takeouts was iRobot, which was furthermore all through the THNQ index. There’s not that masses overlap, however that was one, it was in AI and ROBO play. So I merely needed so as in order so as to add that we’re making strikes there. And I actually really feel what we now have thought-about pretty a bit presently is simply because your full market is down, we’re trying to substantiate we seize the businesses which might be sturdy and under no circumstances merely following in tandem, however we’ll make it potential for they are going to develop market share, have invested precisely, have resilient administration going ahead and to the following quarter and former. So. Yeah.

Jeremie Capron:

All right. Efficiently, I actually really feel we’re happening the hour, so I wish to thank everyone for turning into a member of us at present and remind you you could be a part of a biweekly e-newsletter on the web website online roboglobal.com, the place we share a variety of of our analysis and insights into firms and sectors, robotics, AI, and healthcare know-how. And we very masses stay up for chatting with you as quickly as additional sooner. Thanks.

[ad_2]